Why not...

There is no such thing as normal interest rates. Furthermore, FoF data has shown us that these historically low rates have been appropriate for this economic environment.

Anyone that has any common sense would not make this claim regarding rates. Just because you want rates to go higher does not mean they have to or wil go higher.

"20 year average" is a cherry picked, useless measuring stick.

Also, the debt doesn't roll over all at once.

4 times huh. What is that in real terms? How much of that will make the Treasury-Fed-

treasury loop?

Wrong.

We are currently buying more of our own debt than we are creating. The national debt has gone down, not up.

Throw this out the window. National debt is in no way comparable to personal finance.

We print paper and exchange it for Chinese goods. How does this make us poorer?

Factually incorrect.

Some Euro nations have been forced into austerity because they're chained to a broken system, and refused to ease monetary policy appropriately. Our system is not comparable because we have a central taxing and spending authority. We have the ability to make the adjustments that Euro cannot.

Also factually incorrect.

Recent spending cuts have created more federal deficit and have slowed growth. Economists told us this would happen, but the Tea Party budget hawks refused to listen to the "brain dead Keynesian liberal" professionals. They're stuck in this incorrect understanding of how the world works.

Why on earth would we ever default on our debt?

Nah. We'll just print our way out of the problem if we cannot make the necessary adjustments to keep things in check.

All economies fail. Except ours, because we print the problem out of existence.

1.Of course interest rates are going to go up at some point, if they don't it means that we are remaining in semi permanent recession worldwide and it is being papered over, literally, by the printing of extra money. That solution cannot go on forever and will eventually have consequences.

2.There are no such things as normal rates, just like there is no such thing as "normal" temperature for climate. There are OPTIMAL ranges that people want to see, and it is completely assured that there will be variations high and low of the historical mean. And there is a historical mean, no?

3. At some point rates will go higher, even pretending there is a possibility that this won't happen is Pollyanna idiocy.

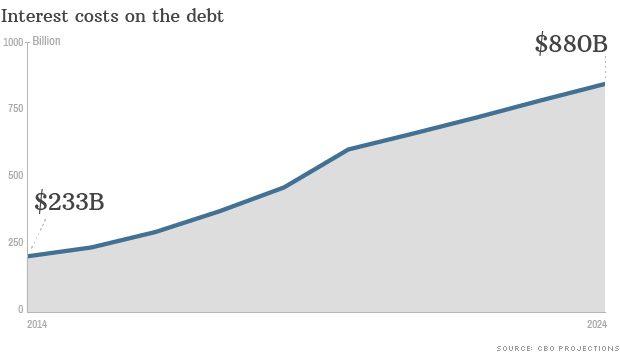

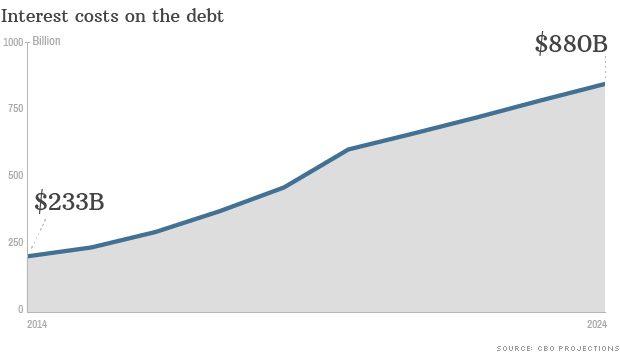

4. Of course as the debt increases the interest will increase. There is almost no room on the low interest side for improvement. All possibilities for change will show increase either because the amount of debt continues to grow or interest rates increase. The most likely forecast for the future is that both will happen, greatly accelerating the real amount of dollars owed in interest.

5. The four times analogy is valid unless you believe the GDP will quadruple in the same amount of time. Perhaps you think that tax receipts will quadruple as well? It means that the interest owed on debt will make up a much larger portion of government spending than it did in the past.

6. Of course increased spending in other areas will limit the amount of social spending available in future years, unless you feel like the American electorate will tolerate massive tax increases, and not just "on the rich."

7. The national debt is not decreasing. We are still spending more as a government than we take in. Nobody with a brain believes you on this point. YOU don't even believe this.

8. Debt is debt. Debt can be useful if used for investment. Right now you are advocating debt for day to day expenses. That is ALWAYS bad debt.

9. Because you assume that that paper will ALWAYS hold the same value. That is more of a wish than a fact. Some other currency was King before the Dollar. The Dollar is not the end of history. Would you take Honduran currency fresh off the press as payment for your services?

10 and on. Your problem is that you accept one interpretation of Keynesian Economics like it is some damn law of nature. It certainly isn't and the penalties for you being wrong are very severe. Its as stupid as picking one climate model and betting the farm on it. You leave no room for variation or possibility for error. I'm not comfortable with that nor should anyone else be. It is however, more acceptable for you because you are not a trained economist. I do have a problem with people who purport to be experts. (Krugman, Piketty, and for that matter Marx) who design their economic theories around their political fantasies and pass it off as truth.