Red

Well-Known Member

Truth Social

Truth Social is America's "Big Tent" social media platform that encourages an open, free, and honest global conversation without discriminating on the basis of political ideology.

Straight up fascist propaganda, no other way to see it. Blatantly false. But hordes of the cult will believe it.

Truth Social

Truth Social is America's "Big Tent" social media platform that encourages an open, free, and honest global conversation without discriminating on the basis of political ideology.truthsocial.com

Yeah, thought about it for awhile, but finally chose “civil war” as my first choice in your “how will it play out” thread. He’s not going anywhere if he’s still alive come Nov., 2028.Straight up fascist propaganda, no other way to see it.

Yeah, thought about it for awhile, but finally chose “civil war” as my first choice in your “how will it play out” thread. He’s not going anywhere if he’s still alive come Nov., 2028.

View: https://www.youtube.com/watch?v=Mo9par4ie6A

And there are a dozen modern 1st world democracies out there right now with functioning pension systems for taking care of retirees, and they are doing way better than we are, where the old are provided for, their rent is subsidized (and even house payments to varying degrees), and they receive enough to have a reasonable retirement at a reasonable age. For most developed countries that is around 66 years. They are seeing an increase in the full retirement age in many developed countries because they are all facing a bubble as the boomers all retire, which has been raising the age for retirement. But still, most every other developed nation has this figured out. Why are we so stuck on this ****? Why can't we figure it out as well? Mainly the answer to that is 2-fold: 1) the 2-party system which makes it so there is little to no competition of ideas, hence nothing driving to get to the best solutions, and 2) lobbying or "legal bribery" which keeps the rich in charge and the politicians in their pockets. We are the only major developed democratic nation with only 2 political parties. We are also one of the only countries that allows lobbying as unfettered as we do, where even the Supreme Court can be bought off by billionaires and have it brought to light, complete with evidence, yet with ZERO consequences. The only other nations that fit this mold are authoritarian regimes, like Russia, Venezuela, and Turkey, where the authoritarians have already taken over. They have 2 political parties or fewer and allow billionaires to control their politicians, while the rich get richer. We have devolved until we have more in common with these dictatorships than we do with any of the other democracies around the world. Trump seizing full power will complete our transformation to Russia-West.Republicans have been having wet dreams over privatization of SS for as long as there’s been SS. Can’t possibly be a surprise that Republicans want to hurt workers….

All the reasons privatizing Social Security would be a terrible idea

Converting Social Security into millions of individual investment accounts would end the program as we know it.www.marketwatch.com

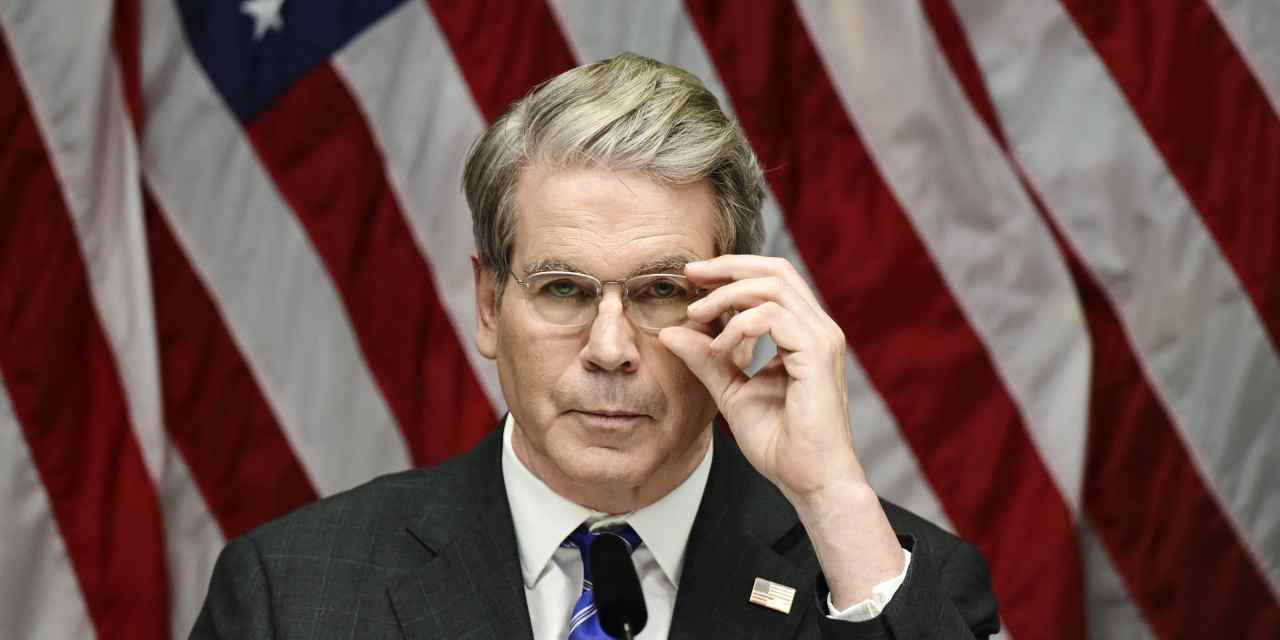

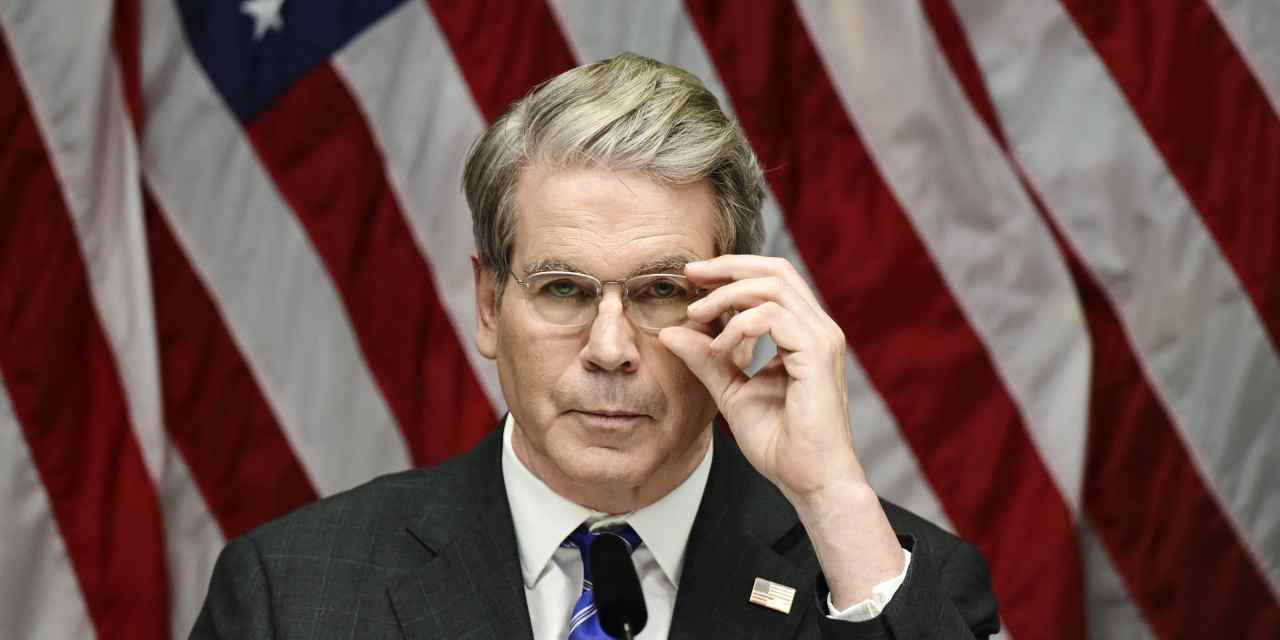

Treasury Secretary Scott Bessent set off a firestorm this week when he said that the Trump administration had just taken the first steps toward a “back door for privatizing Social Security.”

Bessent, speaking to reporters at MAGA news site Breitbart, said this was a feature of the $1,000 investment accounts created for newborns by the One Big Beautiful Bill Act, which President Donald Trump recently signed into law.

“At the end of the day, I am not sure when the distribution level date should be, whether it should be 30 and you can buy a house? Should it be 60? But in a way, it is a back door for privatizing Social Security,” Bessent said. “If, all of a sudden, these accounts grow and you have in the hundreds of thousands of dollars for your retirement, that’s a game-changer, too.”

Whatever Bessent and the administration really think, let’s make one thing absolutely clear. Converting Social Security into millions of individual investment accounts, as some on the right have proposed, would not merely constitute “privatizing” Social Security. It would involve breaking up or ending Social Security as we know it — abolishing the program and putting something new in its place.

Truly “privatizing” Social Security would mean handing over administration of the program and its trust fund to a private company, such as Fidelity or Vanguard, or possibly taking it public on the stock market. There is nothing particularly wrong with this idea in theory, but it would make zero sense in practice. Social Security is already run on a shoestring, while its investment policy — bonds, bonds and only bonds — has been set by Congress. How a private company could add value while extracting a profit for its own stockholders is hard to imagine.

But this is not what has been proposed. Instead, proponents of “privatizing” Social Security are talking about winding down the Social Security trust fund itself, in whole or in part, and replacing it with tens of millions of individual investment accounts. Some or all of the 12.4% flat Social Security payroll taxes would go into these accounts instead of the Social Security trust fund.

This is what Scott Bessent was alluding to when he told Breitbart that the new individual investment accounts were a back door to privatization. And, most famously, this is what President George W. Bush actually proposed 20 years ago — a proposal that sank like a lead balloon.

Whatever you think of this idea, it would be the beginning of the end of Social Security as we know it.

The current program is what’s known as a defined-benefit program, or pension. You are not responsible for the investment returns. What you get out each month in retirement simply depends on what you put in while you were working.

But Social Security is also an insurance program.

It insures us against poverty in old age. That’s why each of us gets credit for 90% of the wages we earn up to a low level, currently $1,226 a month, but much lower percentages for the wages we earn above that. The top priority of the program is that everybody who qualifies gets at least something to live on in retirement.

It insures us against longevity. Social Security pays you until you die, whether that happens when you are young or very, very old.

And it insures us against inflation. The annual cost-of-living adjustment, although it comes a year in arrears, raises benefits in line with consumer prices.

Gradually converting some or all of this program into about 250 million individual accounts would change all of that. (There are currently about 180 million workers paying into the system and 70 million beneficiaries drawing from it.)

The new accounts would have no defined-benefit feature. What you got out at the end would depend not only on your contributions but also on your investment returns. Crucially, the accounts would also have no insurance feature. Higher earners would not cross-subsidize low earners. Those who died young would not cross-subsidize those who lived to 110. Nobody would protect your retirement income from inflation.

This is one of those ideas that sounds better the less you think about it. Once you get into the details, as people did when Bush proposed the idea, it gets less appealing.

I recall he sometimes grew angry, and that was not his style normally, when I brought the subject up!I remember when Al o meter actually thought that trump had nothing to do with project 2025 lol. What a dumbass

lol I was reassured many times on this website that Trump wasn’t going to do project 2025. In fact, wasn’t it something dreamed up by Democrats? LolI recall he sometimes grew angry, and that was not his style normally, when I brought the subject up!

The first step in solving a problem is having a desire to solve it. So these issues are DOA when they go to the Congress and Senate. Republicans are worse on this, but the Democrats aren't great, either.And there are a dozen modern 1st world democracies out there right now with functioning pension systems for taking care of retirees, and they are doing way better than we are, where the old are provided for, their rent is subsidized (and even house payments to varying degrees), and they receive enough to have a reasonable retirement at a reasonable age. For most developed countries that is around 66 years. They are seeing an increase in the full retirement age in many developed countries because they are all facing a bubble as the boomers all retire, which has been raising the age for retirement. But still, most every other developed nation has this figured out. Why are we so stuck on this ****? Why can't we figure it out as well? Mainly the answer to that is 2-fold: 1) the 2-party system which makes it so there is little to no competition of ideas, hence nothing driving to get to the best solutions, and 2) lobbying or "legal bribery" which keeps the rich in charge and the politicians in their pockets. We are the only major developed democratic nation with only 2 political parties. We are also one of the only countries that allows lobbying as unfettered as we do, where even the Supreme Court can be bought off by billionaires and have it brought to light, complete with evidence, yet with ZERO consequences. The only other nations that fit this mold are authoritarian regimes, like Russia, Venezuela, and Turkey, where the authoritarians have already taken over. They have 2 political parties or fewer and allow billionaires to control their politicians, while the rich get richer. We have devolved until we have more in common with these dictatorships than we do with any of the other democracies around the world. Trump seizing full power will complete our transformation to Russia-West.

Who are you, Donald Cline?EGGS ****ING EGGS I NEED EGGS!!!!!

Who are you, Donald Cline?