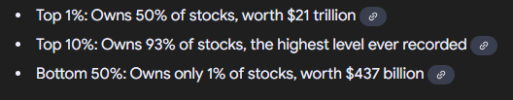

I'm with Fish, IDGAF. but since somebody is demanding the legwork be done for them, here is the reason people are proposing an unrealized gains tax:

View attachment 17092

Authors: Zachary Tashman, senior research & policy associate; and William Rice, senior writer Principal researcher: Zachary Tashman EXECUTIVE SUMMARY According to an analysis by American for Tax Fairness of new Federal Reserve data on household income and wealth, America’s billionaires and...

americansfortaxfairness.org

TL

R - Super-rich people use an untaxable infinite money glitch. They don't sell their stocks, they use the growth in value to borrow and borrow and borrow at low cost. They don't have income like you or me. Income tax rate doesn't work. Capital Gains Tax is not sufficient either.

Will it depress the stock market if this hits? possibly, in the short term. but at the end of the day a 25% unrealized gains tax is a 25% reduction in ROI, The stonks are still going up but not as fast.

How would it work in detail? I don't know, I'm not the IRS and I'm never going to be worth 100 million dollars. I seriously doubt they'd move this tax below the ultra-wealthy mark, there's no upside to doing so.

Also: stop holding water for these parasites. These people make more use of and benefit more from society and our tax-funded infrastructure than anybody else.

I don't blame them for paying the minimum amount of taxes they can, I would too. However, when a novel way to increase their taxes to ensure they pay as much as their vastly poorer brethren is proposed, your first instinct is to defend their honor.