We spend 3.2 trillion a year right now. 10 years that 32 trillion, lets add 20 trillion(completely bogus amount) in inflation and make in 52 trillion. Warrens plan will pay that 32 trillion

plus 24-34 trillion more in 10 years according to her own admission. Right now that is 52 trillion. So how the flying fudge is that paying less? How in world is adding 20 whatever trillion on top of the 32 trillion paying less? You... can't... make... this... stuff... up... lol

Canada also has 296,000,000 less people.

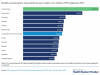

Canadians also reported the longest

wait times for specialists, with 56 per cent

waiting longer than four weeks to

see a specialist, compared with the international

average of 36 per cent.

Why is that you may ask?

Not enough doctors. Why not just buy more?

VANCOUVER — You’d think the average Canadian family spends more on household expenses such as housing, food and clothing combined, but it’s actually taxes, finds a new study by the Fraser Institute.

The think-tank’s Canadian Consumer Tax Index, which tracks the total tax bill of the average Canadian family from 1961 to 2015, reveals the average family (including singles) earned $80,593 and paid $34,154 in total taxes last year, compared to $30,293 on housing (rent and own), food and clothing combined.

That’s 42.4% of income going to taxes and 37.6% going to basic necessities.

https://www.plant.ca/economy/161193-161193/

Basic economics.