I grew up in NYC which has a very high tax rate. My family and I were able to enjoy things like free after school programs, free garbage pick up. As I got older, I went to a state subsidized school that let me study for less than 1K a semester and I could travel on the subway at 3 in morning instead of driving home with a buzz on.

In my late 20's I moved to Round Rock Texas and lived there for 4 years. Zero social services - if anything happens to you, you're pretty much on your own. But there is a much lower cost of living, no state taxes and low proper taxes that enabled me to have more disposible income.

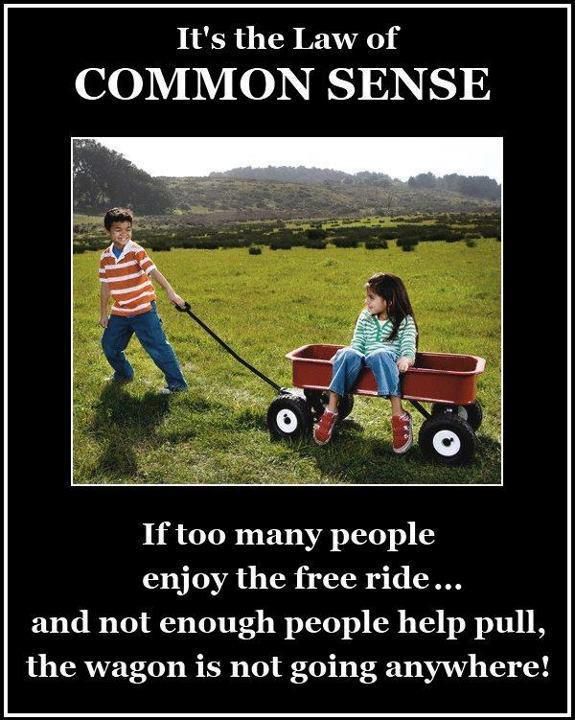

Both places had their advantages and drawbacks. The problem is people want their cake and be able to eat it to. Greece, Spain and Italy are all prime examples. Greece especially is a ****ing joke. The working class wants to keep all the government programs - but NO ONE, rich or poor wants to pay any taxes. Cheating on your taxes and hiding your income is almost a national past time in Greece - which may have something to do with the fact that they really have no equivalent to the IRS.

The bottom line is the electorate as a whole needs to make a choice. Countries, like Germany, Sweden and Norway all have extensive government programs; but they also have high tax rates that pay for them; which is why they're not on the brink of collapse like the rest of Europe.

Luckily for us and unlike are friends on the Euro, we can just print money whenever we want (yes, that was sarcasm).