TheMulletMutilator

Member

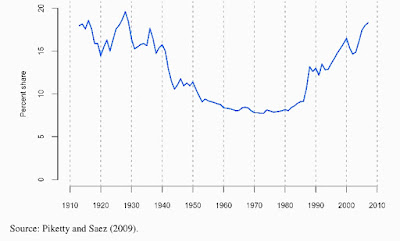

This is a chart of the percentage share of the national income that the top 1% receives over the last 100 years.

As you can see, income inequality is presently the highest it's been since the late 1920s.

Clearly those people are really hurting and need their tax cuts made permanent.

Have you ever seen a poor person hire a workforce and pay them? You may not like the idea of giving tax breaks to the wealthy but truthfully, who creates the jobs in this country? Also what percentage of total tax revenue does that top 1% pay? How about the top 5%? Redistribution of wealth is a nice concept until it makes everyone poor.